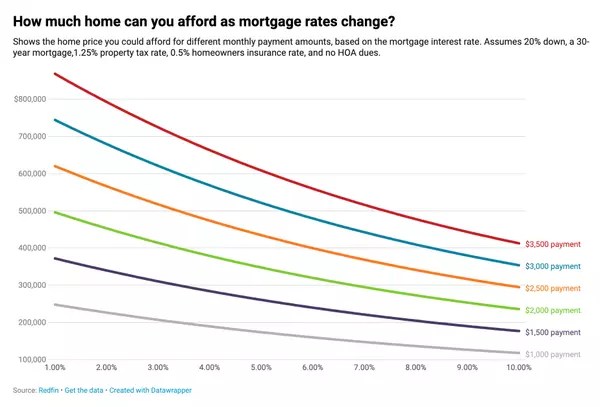

Recent data analysis and expert opinions indicate that hopes for a housing market crash to drive down home prices are unlikely to materialize. Contrary to fears reminiscent of the 2008 housing crisis, current trends suggest that home prices will continue to climb.

One significant factor contributing to the market's stability is the tightening of lending standards. Unlike the lax lending practices leading up to the 2008 crash, today's mortgage companies impose stricter criteria for loan approval. This trend is illustrated in a graph provided by the Mortgage Bankers Association (MBA), depicting the rising difficulty in obtaining mortgages compared to pre-crash levels.

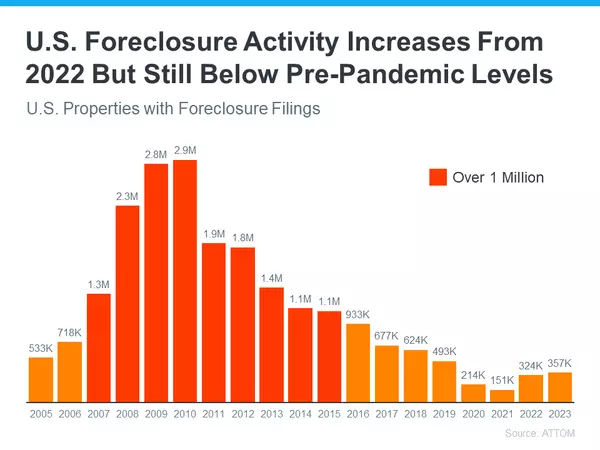

"In the lead-up to the housing crisis, lending standards were significantly looser, resulting in higher risk for both borrowers and lenders," explains a housing market analyst. "This time around, the more stringent lending practices act as a buffer against mass defaults and foreclosures."

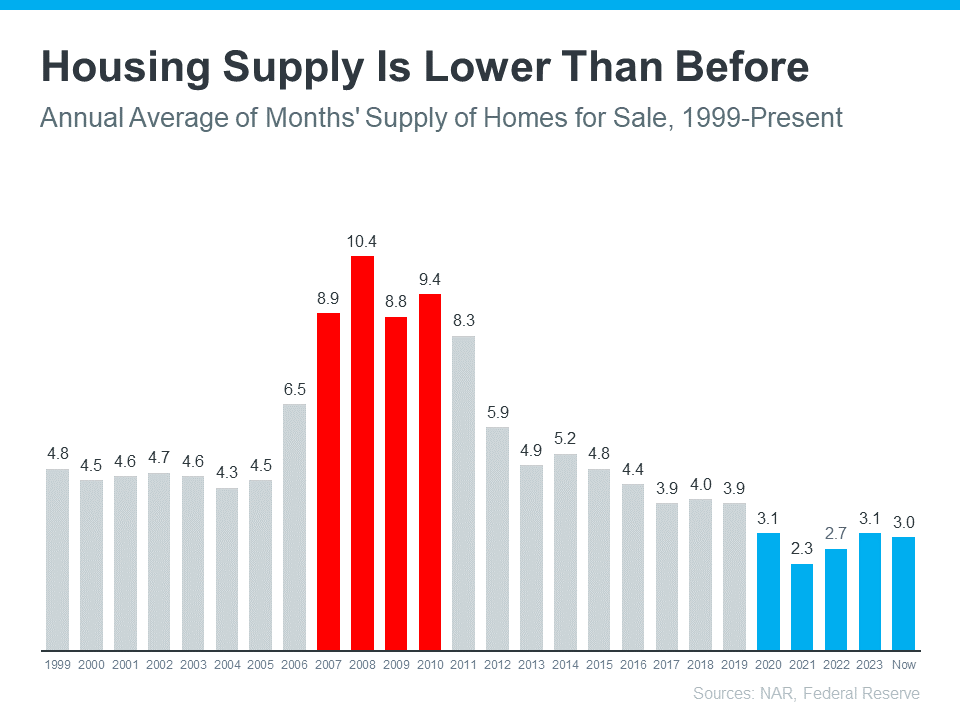

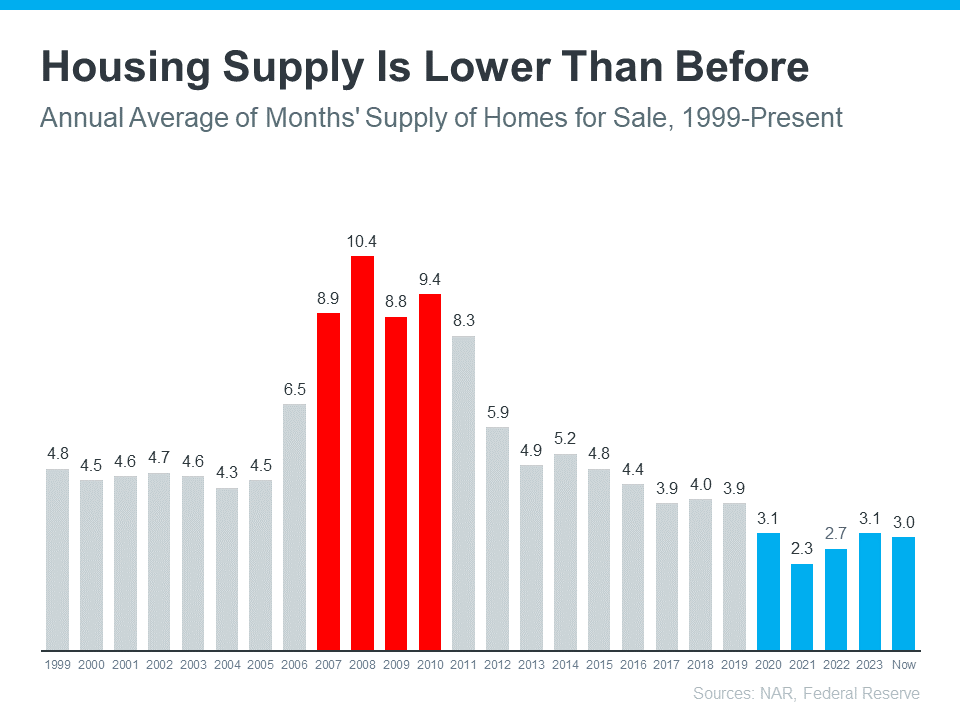

Furthermore, the current housing market faces a shortage of available homes for sale, contrasting sharply with the surplus seen during the 2008 crisis. Data from the National Association of Realtors (NAR) and the Federal Reserve illustrate this inventory shortage, with unsold inventory at a mere 3.0-months' supply compared to the 10.4-months' supply at the peak of the crisis.

"The scarcity of inventory today mitigates the possibility of a price crash seen during the housing crisis," says a real estate expert. "With fewer homes on the market, there's less downward pressure on prices."

Another critical distinction from the pre-crash era is homeowners' behavior regarding home equity. Unlike the early 2000s when homeowners leveraged their equity for non-housing expenses, today's homeowners exhibit greater caution. Black Knight reports a record-high level of tappable equity, indicating homeowners' conservative approach to leveraging their home's value.

"Homeowners' conservative approach to equity utilization reflects a fundamental shift in mindset from the pre-crash era," notes a financial analyst. "This prudent behavior contributes to overall market stability."

The Black Knight report further highlights the robust position of homeowners, with only a minimal percentage facing negative equity compared to previous years. This resilience reduces the likelihood of distressed properties flooding the market, thus maintaining price stability.

In conclusion, while some may anticipate a market correction, current data and analyses paint a different picture. The housing market today operates under fundamentally different conditions than during the 2008 crisis, suggesting that a significant crash in home prices is improbable.