Home Sellers Cut Asking Prices Amid Rising Median Sale Prices

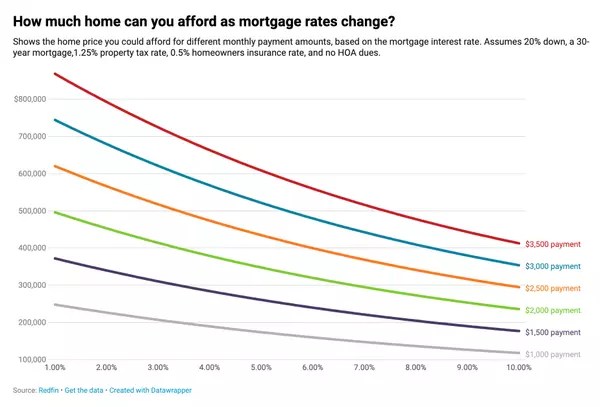

In a sign that the red-hot housing market may be cooling off, more home sellers are reducing their asking prices, hinting at a potential softening in sale-price growth in the near future. However, despite this trend, the median sale price for homes has surged to yet another record high this week, further complicating the landscape for buyers. According to recent data, 6.4% of home sellers across the nation have slashed their asking prices in the four weeks leading up to May 26. This marks the highest share since November 2022. The median asking price has also seen a slight dip of roughly $3,000 to $416,623, the first decline observed in six months. Additionally, the age of inventory, measuring the number of days active listings have been on the market, has started to rise year over year, hitting a median of 46 days in May, suggesting a potential slowdown in sale-price growth. Factors contributing to this potential cooling include persistently high mortgage rates, which have remained a deterrent for some prospective buyers. However, buyers did experience a slight relief this week as the typical monthly housing payment dropped to $2,812, the lowest level seen in six weeks. This decline is attributed to a slight dip in mortgage rates, with the weekly average dropping below 7% for the first time since early April. Despite these shifts, high housing costs continue to dampen demand, with pending sales down 3.4% year over year and mortgage purchase applications hovering near their lowest levels in six months. Low inventory levels also remain a challenge, with fewer new listings hitting the market compared to the same period last year. Christine Chang, a Redfin Premier agent in the Bay Area, noted that while the market is slower than usual, well-maintained properties listed for under a million dollars still garner multiple offers. She advised buyers to consider single-family homes that may need minor updates or explore homes in lesser-known neighborhoods to potentially avoid competition and bidding wars. Condos, which are relatively unpopular at the moment, could also present opportunities for buyers seeking more affordable options.

Read MoreMortgage Rate Optimism: Experts Predict Drop Below 6% by 2024's End

In the realm of real estate, prospective homebuyers have long kept a close eye on mortgage rates, often allowing these figures to dictate the feasibility of their plans. However, recent data and expert insights suggest a promising shift on the horizon, reigniting hopes for many who have pressed pause on their homeownership dreams. According to information sourced from Bright MLS, a significant number of potential buyers have postponed their moves due to the impact of high mortgage rates. CEO of Keeping Current Matters, David Childers, echoed this sentiment in a recent installment of the How’s The Market podcast, highlighting that a substantial portion of buyers have been deterred by soaring rates. Childers remarked, “Three quarters of buyers said ‘we’re out’ due to mortgage rates. Here’s what I know going forward. That will change in 2024.” The optimism stems from the gradual decline in mortgage rates since reaching a peak in October of the preceding year. While fluctuations persist in day-to-day observations, long-term projections suggest a continued descent in rates throughout 2024, contingent upon the containment of inflation. Experts anticipate a potential drop below the 6% threshold by the year’s end, a development that could substantially alter the landscape for aspiring homeowners. A recent article from Realtor.com underscores this sentiment, affirming that while the desire for homeownership remains strong, many individuals are eagerly anticipating a decrease in mortgage rates to facilitate their aspirations. Citing data, the article suggests that four out of 10 Americans eyeing a home purchase in the upcoming year would find it feasible if rates were to dip below 6%. While the exact trajectory of mortgage rates remains elusive, the prevailing optimism among experts offers a glimmer of hope for those who have temporarily shelved their plans. This resurgence of positivity signals a potential green light for reconsideration. For those contemplating their next steps, the pivotal question becomes identifying the threshold at which they feel comfortable resuming their home search. Whether it’s 6.5%, 6.25%, or below 6%, establishing this target provides a clear guidepost for readiness. Armed with this benchmark, individuals are encouraged to engage with local real estate professionals who can offer valuable insights and keep them abreast of market developments. These experts serve as invaluable allies, ensuring that buyers are well-positioned to seize opportunities as soon as they arise. In conclusion, if high mortgage rates have compelled you to defer your relocation plans, now is the time to contemplate the figure that would prompt your re-entry into the market. With a clear goal in mind and the support of real estate professionals, the path to homeownership becomes illuminated once again.

Read MoreHousing Market Crash Unlikely, Home Prices Expected to Rise

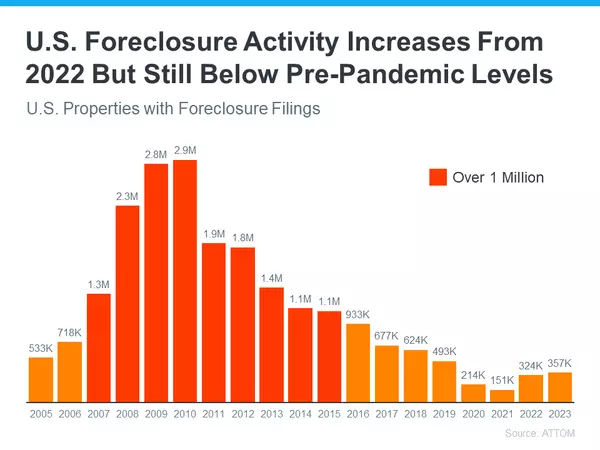

Recent data analysis and expert opinions indicate that hopes for a housing market crash to drive down home prices are unlikely to materialize. Contrary to fears reminiscent of the 2008 housing crisis, current trends suggest that home prices will continue to climb. One significant factor contributing to the market's stability is the tightening of lending standards. Unlike the lax lending practices leading up to the 2008 crash, today's mortgage companies impose stricter criteria for loan approval. This trend is illustrated in a graph provided by the Mortgage Bankers Association (MBA), depicting the rising difficulty in obtaining mortgages compared to pre-crash levels. "In the lead-up to the housing crisis, lending standards were significantly looser, resulting in higher risk for both borrowers and lenders," explains a housing market analyst. "This time around, the more stringent lending practices act as a buffer against mass defaults and foreclosures." Furthermore, the current housing market faces a shortage of available homes for sale, contrasting sharply with the surplus seen during the 2008 crisis. Data from the National Association of Realtors (NAR) and the Federal Reserve illustrate this inventory shortage, with unsold inventory at a mere 3.0-months' supply compared to the 10.4-months' supply at the peak of the crisis. "The scarcity of inventory today mitigates the possibility of a price crash seen during the housing crisis," says a real estate expert. "With fewer homes on the market, there's less downward pressure on prices." Another critical distinction from the pre-crash era is homeowners' behavior regarding home equity. Unlike the early 2000s when homeowners leveraged their equity for non-housing expenses, today's homeowners exhibit greater caution. Black Knight reports a record-high level of tappable equity, indicating homeowners' conservative approach to leveraging their home's value. "Homeowners' conservative approach to equity utilization reflects a fundamental shift in mindset from the pre-crash era," notes a financial analyst. "This prudent behavior contributes to overall market stability." The Black Knight report further highlights the robust position of homeowners, with only a minimal percentage facing negative equity compared to previous years. This resilience reduces the likelihood of distressed properties flooding the market, thus maintaining price stability. In conclusion, while some may anticipate a market correction, current data and analyses paint a different picture. The housing market today operates under fundamentally different conditions than during the 2008 crisis, suggesting that a significant crash in home prices is improbable.

Read More

Categories

Recent Posts