In the realm of real estate, prospective homebuyers have long kept a close eye on mortgage rates, often allowing these figures to dictate the feasibility of their plans. However, recent data and expert insights suggest a promising shift on the horizon, reigniting hopes for many who have pressed pause on their homeownership dreams.

According to information sourced from Bright MLS, a significant number of potential buyers have postponed their moves due to the impact of high mortgage rates. CEO of Keeping Current Matters, David Childers, echoed this sentiment in a recent installment of the How’s The Market podcast, highlighting that a substantial portion of buyers have been deterred by soaring rates.

Childers remarked, “Three quarters of buyers said ‘we’re out’ due to mortgage rates. Here’s what I know going forward. That will change in 2024.”

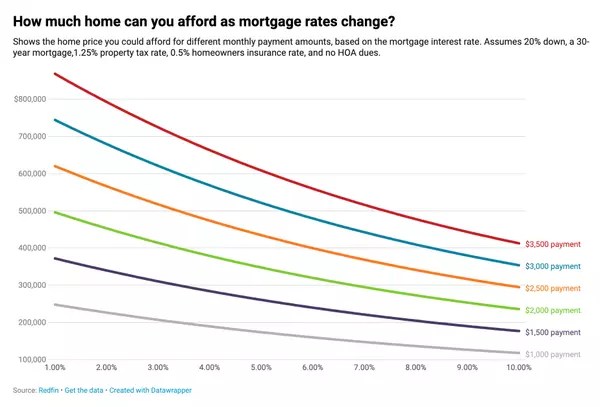

The optimism stems from the gradual decline in mortgage rates since reaching a peak in October of the preceding year. While fluctuations persist in day-to-day observations, long-term projections suggest a continued descent in rates throughout 2024, contingent upon the containment of inflation. Experts anticipate a potential drop below the 6% threshold by the year’s end, a development that could substantially alter the landscape for aspiring homeowners.

A recent article from Realtor.com underscores this sentiment, affirming that while the desire for homeownership remains strong, many individuals are eagerly anticipating a decrease in mortgage rates to facilitate their aspirations. Citing data, the article suggests that four out of 10 Americans eyeing a home purchase in the upcoming year would find it feasible if rates were to dip below 6%.

While the exact trajectory of mortgage rates remains elusive, the prevailing optimism among experts offers a glimmer of hope for those who have temporarily shelved their plans. This resurgence of positivity signals a potential green light for reconsideration.

For those contemplating their next steps, the pivotal question becomes identifying the threshold at which they feel comfortable resuming their home search. Whether it’s 6.5%, 6.25%, or below 6%, establishing this target provides a clear guidepost for readiness.

Armed with this benchmark, individuals are encouraged to engage with local real estate professionals who can offer valuable insights and keep them abreast of market developments. These experts serve as invaluable allies, ensuring that buyers are well-positioned to seize opportunities as soon as they arise.

In conclusion, if high mortgage rates have compelled you to defer your relocation plans, now is the time to contemplate the figure that would prompt your re-entry into the market. With a clear goal in mind and the support of real estate professionals, the path to homeownership becomes illuminated once again.