North Carolina Faces Potential Surge in Homeowners' Insurance Rates

In a recent announcement, North Carolina Insurance Commissioner Mike Causey has disclosed a significant development in the state's insurance landscape. The North Carolina Rate Bureau has officially submitted a rate filing to the North Carolina Department of Insurance, seeking approval for an average statewide increase of 42.2% in homeowners' insurance rates. The filing was made on a Wednesday, with the proposed effective date for the new rates set for August 1. The North Carolina Rate Bureau, distinct from the Department of Insurance, represents companies involved in writing insurance policies within the state. This move follows a previous homeowners' insurance rate filing in November 2020, where the Rate Bureau initially sought an overall average increase of 24.5%. However, after negotiations between Commissioner Causey and the Rate Bureau, a settlement was reached for a more moderate overall average rate increase of 7.9%. Recognizing the significance of public input, a mandated public comment period has been initiated to provide citizens with an opportunity to address the proposed rate increase. Various channels are available for submitting comments, including an in-person public comment forum scheduled for January 22 at the Jim Long Hearing Room in Raleigh from 10 a.m. to 4:30 p.m. Simultaneously, a virtual public comment forum will be held, accessible here. Additionally, citizens can share their views through emailed comments to 2024Homeowners@ncdoi.gov or written comments to Kimberly W. Pearce, Paralegal III, at 1201 Mail Service Center, Raleigh, N.C. 27699-1201, by February 2. With all public comments to be shared with the North Carolina Rate Bureau, the Department of Insurance officials will carefully review the proposed rates. If an agreement cannot be reached, the Commissioner has the authority to either deny the rates or negotiate with the North Carolina Rate Bureau. If a settlement proves elusive within 50 days, a hearing will be called. For those seeking a detailed breakdown of proposed homeowners' rate increases across the state, a specific table can be accessed here. In an effort to dispel confusion surrounding the recent filing, Commissioner Causey issued a statement emphasizing the citizens' concerns and the department's commitment to fairness. He clarified that the Commissioner of Insurance does not independently set insurance rates; rather, it is the Rate Bureau, an entity created by the N.C. General Assembly, that submits proposed rates. The Commissioner highlighted the ongoing 50-day review period, concluding on February 22, during which the Department's actuaries, attorneys, and consultants will evaluate the proposed increase's fairness and actuarial soundness. In response to citizen apprehensions expressed during a recently held public comment forum, Commissioner Causey assured that the Department is tirelessly working to make a well-informed decision. Should the proposed increase be deemed excessive, inadequate, or unfairly discriminatory, the Commissioner pledged to call for a hearing and advocate for reasonable and actuarially sound rates. To address consumer inquiries and concerns, the Department encourages individuals to visit www.ncdoi.gov or contact the toll-free helpline at (855) 408-1212. This unfolding saga highlights the complexities surrounding the proposed surge in homeowners' insurance rates in North Carolina, with Commissioner Causey at the forefront of efforts to ensure a fair and well-informed decision-making process.

Read MoreIncreased Home Listings Signal Market Shift Amid Falling Mortgage Rates

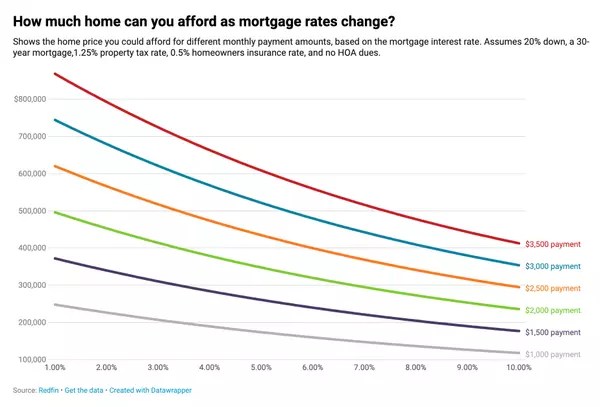

Homeowners Responding to Lower Rates by Listing Properties In a positive turn for prospective homebuyers, the recent decline in mortgage rates is not only enhancing affordability but also inspiring a surge in homeowners putting their properties up for sale. The Mortgage Rate Lock-In Effect Over the past year, a significant factor constraining housing market options has been the limited availability of homes for sale. Many homeowners chose to postpone selling their houses when mortgage rates increased. An article from Freddie Mac sheds light on this trend, stating, "The lack of housing supply was partly driven by the rate lock-in effect... With higher rates, the incentive for existing homeowners to list their property and move to a new house has greatly diminished, leaving them rate locked." Early Signs of Homeowners Ready to Move Recent data from Realtor.com reveals a notable increase in new listings (homes put up for sale) in December 2023 compared to the same month in 2022. This development is particularly significant as the housing market traditionally experiences a slowdown in the later months of the year, with some sellers opting to delay their moves until January. Breaking a Pattern Since 2020 This marks the first time since 2020 that there has been an uptick in new listings during this time of the year. Analysts speculate that this could be indicative of the easing of the rate lock-in effect in response to lower mortgage rates. Implications for Homebuyers While the surge in new listings doesn't guarantee an immediate influx of options for home seekers, it does suggest that more sellers are considering listing their properties. The Joint Center for Housing Studies (JCHS) notes, "A reduction in interest rates could alleviate the lock-in effect and help lift homeowner mobility... Further decreases would reduce the barrier to moving and give homeowners looking to sell a newfound sense of urgency." What It Means for You As mortgage rates continue to decrease, more sellers may re-enter the market, providing potential homebuyers with a greater selection of options. It is advisable for buyers to connect with a real estate agent who can serve as a local expert, keeping them informed about the latest listings in their area. The decline in mortgage rates is prompting a potential increase in home listings, presenting an opportunity for homebuyers to find their ideal homes.

Read MoreHousing Market Experts Optimistic About Home Price Growth in 2024

Survey Reveals 24% Fear Home Prices Will Decline, But Experts Predict Modest Increase In the face of a national trend of rising home prices, a notable 24% of individuals remain apprehensive about a potential decline in the housing market, according to a recent survey conducted by Fannie Mae. The findings indicate that nearly one in four people harbor concerns about the future trajectory of home prices. To alleviate these fears, industry experts have provided insights into the expected trends for the coming year. Modest Increase Anticipated by Experts A comprehensive analysis of the latest home price forecasts from eight distinct sources reveals a consensus among experts. On average, the blue bar on the left of the graph illustrates that these professionals anticipate a modest increase of over 2% in home prices by the end of the current year, dispelling the notion of a decline. Forecasts suggest that the housing market is unlikely to witness depreciation in 2024. The prevailing factors contributing to this projection include a tight inventory and the influence of lower mortgage rates, which are fostering robust buyer demand. Selma Hepp, Chief Economist at CoreLogic, elaborated on this, stating, "With mortgage rates dropping, demand for homes in early 2024 is likely to be strong and will again put pressure on prices, similar to trends observed in early 2023... Most markets will continue to reach new home price highs over the course of 2024." What Does This Mean for Prospective Buyers? The consensus among experts that home prices will rise in the coming year brings positive news for potential homebuyers. The increase in home value is a crucial aspect of homeownership, as it contributes to building equity over time, making it a sound investment. Furthermore, the anticipated appreciation in home prices implies that delaying a home purchase may result in higher costs. For those ready, willing, and able to buy, experts advise against waiting, emphasizing the potential financial implications. Despite concerns expressed by a segment of the population, experts remain optimistic about the housing market's performance in 2024. The prevailing consensus suggests that home prices are more likely to rise than fall. Individuals with questions or apprehensions about local market dynamics are encouraged to consult with a real estate agent for personalized insights and guidance.

Read More

Categories

Recent Posts